By Amy Fletcher

•

June 3, 2025

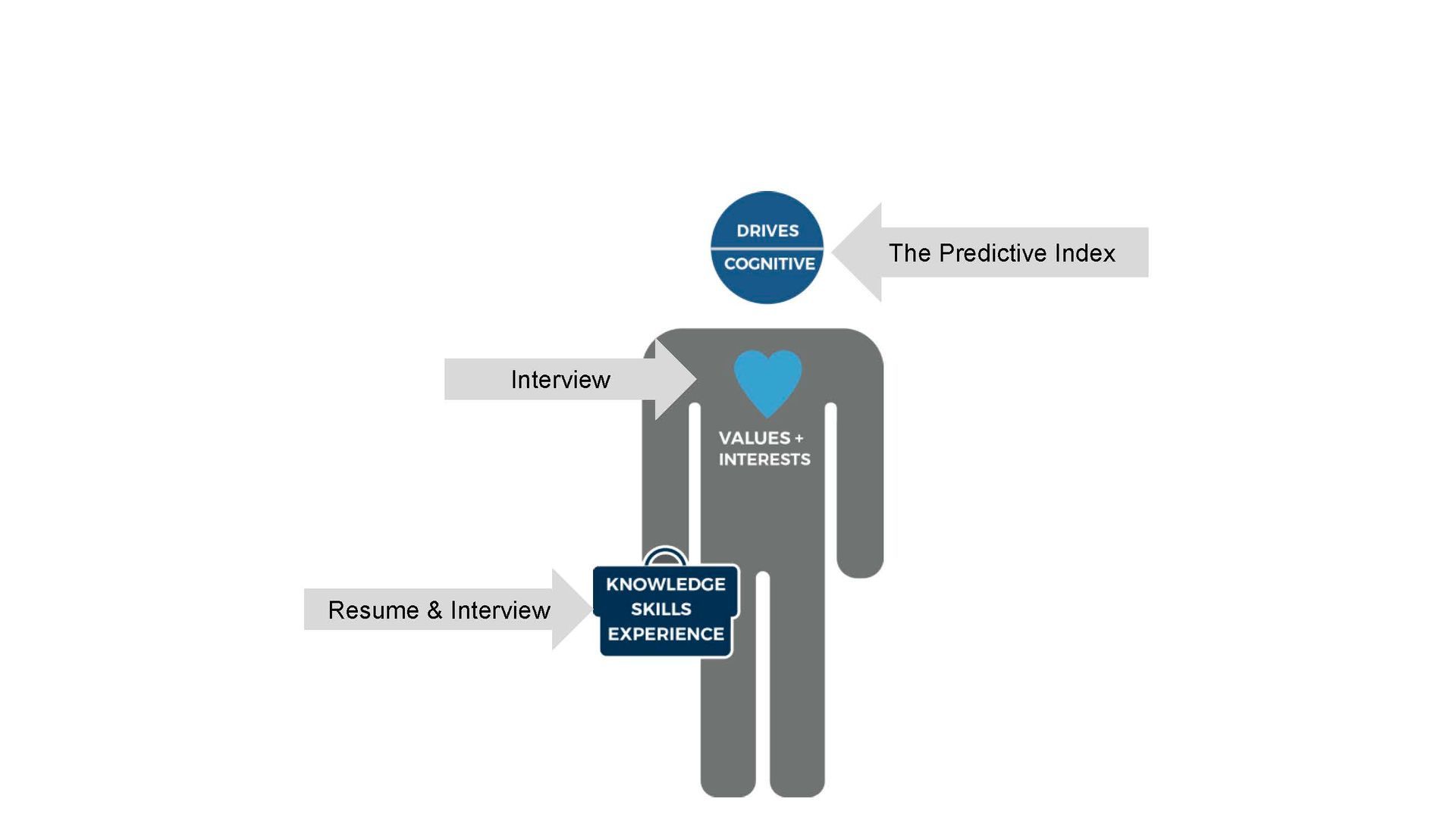

My husband spent more than 30 years in executive operations roles—directing teams, solving complex business problems, and navigating high-pressure environments. He was good at it. Strategic, steady, decisive. And while it served our family well and fulfilled a sense of responsibility, he never really loved it. What he always wanted to do was be a police officer. Over the years, he volunteered with local agencies. He did community patrols, supported traffic stops, showed up where he could. It scratched the itch but never fully satisfied it. Then, in what we jokingly call his “pre-retirement retirement,” he joined a local police force full-time. At 60 years old. Bulletproof vest, cruiser, the whole thing. This week, he was the first on the scene at a home where a man, roughly his age, was unresponsive. No pulse. No breathing. My husband performed CPR until paramedics arrived. The man didn’t make it. This is not the second act we imagined. It’s physically demanding. It’s emotionally intense. It’s dangerous. But he comes home lit up with purpose. He is more exhausted, more alive, and more himself than I’ve ever seen. And watching it unfold has shifted how I think about work, people, and what truly unlocks performance. The Realization We talk a lot about purpose at work as if it’s the single key to fulfillment. But in reality, purpose is just one part of the equation. The people who are most engaged and successful, whether they’re writing reports or responding to 911 calls, tend to be doing work that intersects somewhere with three things: What they’re naturally good at What gives them a sense of purpose or meaning And what meets a real need in the world (which, let’s be honest, often means someone will pay for it) My husband is a protector. He’s calm in a crisis and brave in ways I deeply admire. He believes in the good that law enforcement can do, and he wants to be part of making it better. He’s not doing it for the paycheck, but his role is needed, and the value he brings is recognized. That alignment....strength, purpose, and need...creates a kind of energy that can’t be faked. Even in the hardest moments, he’s grounded. Clear. Alive. And it made me think: what if more of us, especially business owners and leaders, thought about alignment this way when hiring, developing, or repositioning our people? Alignment in Action For the past decade I have been helping leaders and small businesses develop and retain great people and I see it all the time: smart, capable employees stuck in the wrong roles. They’re hired for a gap, slotted into a job, and expected to flourish based on skill alone. But humans are more complex than job descriptions. They need alignment to thrive. But small business owners don’t always have the luxury of trial-and-error hires or mismatched roles. Every seat matters. Every person carries weight. When someone is out of sync; misaligned with their strengths, disconnected from purpose, or unsure how their work contributes; it doesn’t just affect that individual. It slows the entire team. It drains morale. It creates drag where there should be momentum. The best leaders I know don’t just hire for experience. They dig deeper: What energizes this person? When do they do their best work? What kind of environment or structure brings out their best? Do they understand how their role contributes to something meaningful? It’s not always easy to get this right. People grow, shift, evolve. What was once a great fit may now feel stale. But when we pause to consider these dimensions—not just at the point of hire, but throughout someone’s time with the organization we unlock something far more powerful than performance reviews or incentives: we tap into intrinsic motivation. Just like my husband found in his second act, alignment isn’t about chasing passion at the expense of practicality. It’s about positioning people where they can contribute meaningfully, grow naturally, and feel connected to a greater purpose. That’s not fluff. That’s strategy. Three Practical Ways to Spot (and Support) Better Alignment Understanding and fostering alignment doesn’t require a massive overhaul or complicated assessments. Here are three simple steps any small business owner or leader can take today to help put people in roles where they can truly succeed: 1. Conduct a “Strengths Recheck” People grow and change and so do their strengths, needs and desires. Take a moment to check in with your team beyond their job descriptions. Ask questions like: What parts of your work energize you? What tasks feel draining or frustrating? If you could spend more time doing one thing, what would it be? These conversations might reveal hidden talents or interests you hadn’t considered. You don’t have to reshuffle the entire org chart, but small tweaks can unleash big results . 2. Add “Purpose Fit” to Regular Conversations During one-on-ones, reviews, or casual check-ins, include a question about meaning: “Does the work you’re doing feel purposeful or meaningful to you?” It’s okay if the answer isn’t a resounding “yes.” The goal is to understand what motivates each person and what they find rewarding. This insight helps you support them better and can guide future role adjustments or development opportunities. 3. Map the Alignment Triangle For each key role or team member, think through these three questions: What are they really good at? What gives them a sense of purpose in their work? What needs does the business have that align with those strengths and purpose? Even if it’s not a perfect match, this mental mapping helps you identify gaps and opportunities. Sometimes the best solution is a small shift like adjusting responsibilities or pairing team members in complementary roles. Final Reflection Watching my husband step away from an role into the demanding, unpredictable world of law enforcement has been a powerful lesson, not just about courage, but about the true nature of work and fulfillment. It reminded me that alignment is rarely simple or static. People aren’t just skills and tasks on a resume; they are complex, evolving beings with multiple dimensions and needs. For business owners, this means your most valuable asset, the people on your team, thrive when you see them as whole individuals. When you take the time to align what they’re good at, what fuels their purpose, and what your business truly needs, you create more than just productivity. You create engagement, resilience, and a team that can weather challenges and grow stronger together. It’s not a one-time fix, but an ongoing conversation and commitment. And the ROI? It’s more than dollars and cents, it’s a culture where people want to show up, give their best, and stick around. If there’s one takeaway I hope you hold onto from this story, it’s this: don’t settle for the easy hire or the “good enough” role fit. Invest in alignment. It’s worth it. For your people, for your business, and quite frankly for the world.